BTW, how do you define and measure a "breakout" year for a company?

There are no doubts about desirability of Isilon clustering technology and the growth of the targeted media and entertainment segment. But in the short-term, Isilon need to cleanup the mess to benefit from this market opportunity, sooner the better. There are three main hurdles with rebound of Isilon - Financial concerns, impact of loss of revenue from key customers and product quality/service issues.

Financial Concern

The financial concerns about Isilon are primarily resulting from delay in 10-Q filing, bane of being a public company. Also, Isilon didn't do a great job of managing the market expectations, for example releasing the bad news slowly (financial restatements, executives change, revenue shortfalls, delay in 10-Q filing). Typically, public companies release all bad news in one shot, take a big hit in the market and then move on instead of slow bleed in the market.

I wonder, like DGM, how many future customers are sitting on the fence concerned about long-term financial viability of Isilon.

And then there's the other problem - googling for technical information I came across a whole set of entries suggesting that there might be some financial problems in the parent.Loss of Key Customer

As mentioned in 8-K filed Nov 4, 2007, it seems Isilon has some issues accounting for sales to certain resellers and customers. Also, as mentioned by Seeking Alpha, one of Isilon's largest customer Kodak accounted for no revenue in Q3 of 2007.

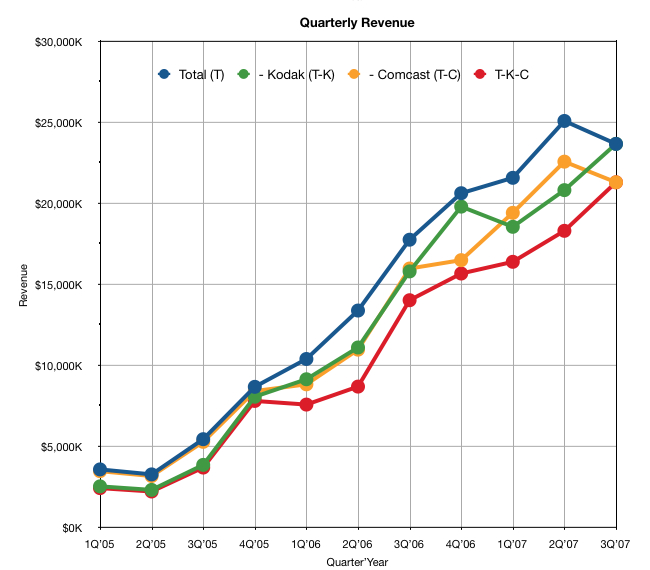

Company blamed one of its largest customers - Kodak (EK) (17% of revenues last quarter went to 0% this quarter - ZILCH) amongst weakness in Europe for the short-fall.How much of the impact does these two events have on the bottom line going forward? I decided to take a look at Isilon revenue with and without two of its largest customers - Eastman Kodak and Comcast for last few years.

A quick note about the assumptions and trends in the above charts:

- No revenue from Kodak in Q3'07

- No change in % quarterly revenue contribution by Comcast in Q3'07 from previous quarter and same % as in Q3'06.

- For the quarters, where % revenue contribution by Comcast or Kodak were not available, estimates are made based on % annual revenue contribution.

- Closer the - Kodak or - Comcast curves to Total curve, lower the contribution by those customers to total revenue.

Service/Product Quality

As any product company selling to large enterprise learns sooner or later that an internal post sales service organization complementing third party service providers is needed to provide exceptional service. It seems recently Isilon has been building up its internal service capabilities.

The change in contract manufacturer seems reasonable considering agreement was close to expiration though I expect there will be short-term hardware quality pain during the transition and ramp up. I couldn't find any smoking gun to support any talk about product operation or compatibility issues.

Summary

My take is that addressing financial concern should be Isilon's top priority. Clearing the financial picture will be the main hurdle in their rebound. It is also great to see Isilon returning to its roots in technology and product innovation instead of trying process innovation like established companies.

Mr. Gupta

ReplyDeleteThank you for the great synopsis regarding this organization. I would be interested in your current view on the stability of the company and how you percieve their overall position in the market for 2009.

Regards,

cathleen