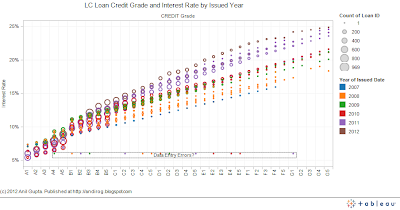

Loan Credit Grade and Interest Rate

The chart below shows the Interest Rates as a function of Credit Grade for all years of loan issued since 2007. The size of the circle indicates the number of loans issued at the specified interest rate and credit grade. The color of the circle indicates the year in which loan was issued.- The chart indicates a few loans under all credit grades issued at 6% interest rates. These appear to be data entry errors.

- From year 2007 through 2010, the Interest Rates for loans rose somewhat linearly with Credit Grades. Since 2011, the relationship between interest rates and credit grades have become curved, an indication of evolving default risk modeling with experience at Lending Club.

- The interest rates for A grade loans have declined while interest rates for other credit grade loans have risen over the years. I suspect Lending Club is trying to attract high credit quality borrowers by reducing the interest rates on grade A loans.

- For each credit grade, interest rates seems to change during the year. As my previous post Lending Club Base Interest Rate - Excess Lending Capital Supply mentions, Lending Club adjusts the interest rates multiple times during the year.

The chart below shows the Interest Rates as a function of Credit Grade for the month of February 2012. Unlike the previous chart which shows loan issued year, this chart shows the loan listing month. As the chart shows, there were two sets of interest rates for most loan credit grades. This indicates that February was the month when Lending Club adjusted the interest rates on loans.

- The lenders would have received additional 1+% interest on their notes of same credit grades if they waited until February when loan interest rates were adjusted upward.

- By waiting for interest rate revision, the lenders would have reduced the default risk (as measured by the credit grade) by buying the loans at similar interest rates but of higher quality credit grade.

Similar chart for the months when Interest Rate changed in 2011 is shown below. In 2011, interest rates were revised in the months of January, April, June, and September (four times). In 2010, the interest rates were revised in January, May, and October (three times). In 2009, the interest rates were revised in July (one time). These observations indicate that there is no pre-determined schedule and interval for reviewing and revising the interest rates.

The interest rate revision, however, appears to be triggered by an external event. Even though, there is not enough data points to support and I am not very confident, the external event appears to be the spread between Commercial bank interest rate on credit card plans and Average rate on 6-month CD, as discussed in previous post. It appears a change of 2+% in the spread triggers a review of current interest rates on Lending Club.

The chart below shows the Average Interest Rates as a function of Credit Grades plotted for each year.

- The average interest rate for Grade A loans are at least 1% lower for the loans issued since 2010 than that issued prior to 2010. The average interest rate for all grades, except A, is consistently rising year over year.

- Since 2010, the average interest rate curve for grade A and B loans have steeper slope than that for other grades. Assuming the credit grade represents default risk, lenders can receive better risk-adjusted return (more bang for the buck) by focusing on credit grades where the slope of the curve is highest, i.e. the interest rate rise faster than the credit grade. From the chart below, loans with credit grade A and B may offer highest risk-adjusted returns.

Key Takeaways

- It may be beneficial to hold on or speed up purchasing notes when interest rate may be adjusted.

- In order to know when Lending Club might review and revise interest rate, the spread between interest rate on credit card and interest rate on 6-month CD may provide a clue.

- The better risk-adjusted return may be obtained with loans of credit grade A and B if default risk is evenly distributed from A1 to G5.

Recently, Richard published an interesting post Using the Social in Social Lending about how he selects loans using the descriptions and answers provided by the borrowers. He is definitely on to something that can be used as qualifying criteria. Check it out.

The language and persuasion in online peer-to-peer lending market has been of great interest to academic researchers also. I came across a particularly interesting research paper Peer to Peer Lending: The Relationship Between Language Features, Trustworthiness, and Persuasion Success published in Journal of Applied Communication Research. Unfortunately, the full text is behind a paywall but you may be able to request a copy from author Laura Larrimore. The abstract mentions:

"The use of extended narratives, concrete descriptions and quantitative words that are likely related to one's financial situation had positive associations with funding success which was considered to be an indicator of trust. Humanizing personal details or justifications for one's current financial situation were negatively associated with funding success."

Need to send large files, use YouSendIt.

No comments:

Post a Comment