In this post, I review the states where borrowers' live and find potential trends and patterns. There is general perception online by Lending Club lenders that California borrowers have higher defaults. I wanted to find out the validity of such views. Personally, in my personal P2P lending, I do not take into consideration the state of residence of borrower. Similarly, the Founders' Filter at PeerCube doesn't exclude loans based on the borrower's state of residence.

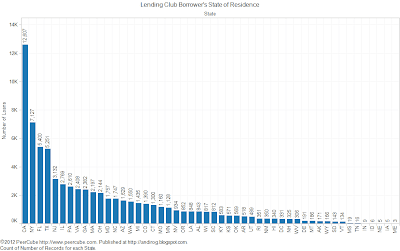

Borrower's State of Residence and Loan Volume

As the chart below shows, since 2007, more than 40% of all loans were issued to borrowers residing in California, New York, Florida, and Texas. Less than 100 loans combined have been issued to borrowers residing in Mississippi, Tennessee, Indiana, Idaho, Nebraska, Iowa and Maine.For further analysis, I decided to combine states in Others group that accounted for less than 200 loans issued each. In addition to states listed above with less than 100 loans, this group also includes Delaware, Montana, Alaska, Wyoming, South Dakota, and Vermont.

The chart below shows the distribution of states as a function of loan application date. The state composition appears to be more or less same for past several years. Considering California, New York, Florida and Texas being most populous states, the trend of most borrowers from these states is not surprising.

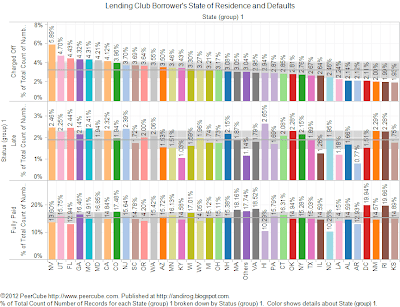

Loan Status

The chart below shows the loan status for borrowers from different states for all loans issued since 2007. One observation right away stands out is that borrowers residing in California don't have exceptionally high default rate. Borrowers residing in Nevada, Utah, Florida, Missouri, and Maryland have higher default rate than borrowers residing in California. Borrowers from Alabama, Arkansas, Washington DC, New Mexico, Rhode Island and Kansas appear to have lowest default rate.Even after excluding loans from years 2007 through 2009 (charts not shown), there was no evidence that borrowers from California have exceptionally higher default rate.

Key Takeaway

- There is no evidence from above default rate analysis that borrowers from California have greater tendency to default compared to other borrowers.

- The perception of higher defaults for California borrowers may be due to significantly large number of loans issued to borrowers from California (12,607) thus large number of loans in defaults (4.12% * 12,607 = 520) but not necessarily due to higher default rate.

Anil, I think CA has been improving for some time but when I did some analysis 18+ months ago they were one of the worst performing states (after NV) as far as default rates go. But based on recent performance I am including them in my selection criteria now. Good update.

ReplyDeleteThanks Peter. It depend on how many states someone want to exclude as CA is 7th worst state in this analysis. By excluding CA and FL, a large number of loans get excluded from investment. I am looking forward to seeing how these states stack up on bad loan experience index.

Delete