Continuing the year-end review of Lending Club loans from my

previous post where I discussed Loan Volume and Amount Funded ...

Interest Rate

In 2012, Lending Club increased the interest rates for most credit grade three times, in January, March, and July of 2012. By the end of 2012, the interest rate for loans ranged from 6.03% for credit grade A1 to 24.89% for credit grade G3, G4, and G5. I am happy to see Lending Club continuing to tweak interest rates and making loans more expensive for lowest quality borrowers. It will be great if in 2013 Lending Club can start issuing a summary of discussions from their Interest Rate pow-wow at least every quarter. I'm interested in knowing what made Lending Club to decide to change the rates.

|

| 2012 Interest Rate and Credit Grade for Lending Club Loans |

As seen from the loan volume chart in my previous post, raising interest rates doesn't seem to have much impact on loan demand. But is the slowdown in loan volume growth in second half of the year due to interest rate hike in July? The average interest rate for loans has risen about 13% from 12.49% in January to 14.12% in December. The average interest rate (13.64%) in 2012 was the highest compared to previous five years; it has increased over 10% from the average interest rate in 2011. I'm afraid that higher average interest rate may lead to higher default rates.

|

| Average Interest Rate for Lending Club Loans in 2012 |

|

| Average Interest Rate, year over year for Lending Club Loans |

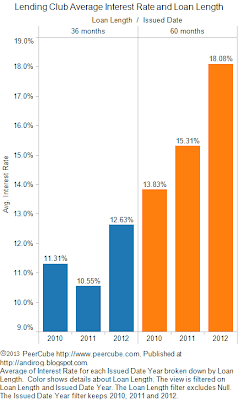

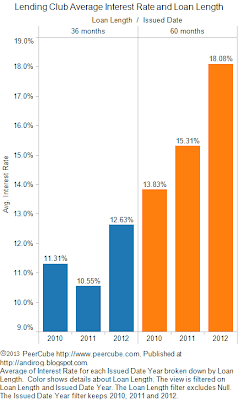

The average interest rate for loans with 36 month term and 60 month term in 2012 was 12.63% and 18.08% respectively. The rise in average interest rate for both loan terms was similar from previous year.

|

| Average Interest Rate for Lending Club Loans with 36 month and 60 month terms |

Credit Grade

The Credit Grade and its relationship with Loan Volume, Total Amount Funded, and Interest Rate has already been discussed in

previous post and earlier in this post. The lower quality loans with credit grade E, F, and G are continuing to be dominated by loans with 60 month terms in 2012. Since 2010 when Lending Club first issued 60 month term loans, 23.85% of all loans have been issued with 60 month term. Year 2013 will be a pivotal year in better understanding the defaults behavior of 60 month term loans as such loans are reaching mid-way point in their maturity cycle. This will also offer better insights into lower quality loans as such loans recently have been primarily 60 month term loans.

|

| Credit Grade and Loan Term for Lending Club Loans, 2010 - 2012 |

Loan Purpose

In 2012, Lending Club borrowers reported loan purpose as debt consolidation and credit card refinancing 77% of the time. Year over year, the percentage of loans with reported loan purpose of debt consolidation and credit card refinancing continues to rise. 77.15% of total amount raised in 2012 was used to fund loans with reported loan purpose of debt consolidation and credit card refinancing. This is an increase of almost 25% over 2011.

At this growth rate, soon loan purpose attribute will become irrelevant as a selection criteria for loans. There is nothing stopping borrowers from claiming debt consolidation and credit card refinancing by running expenses for other loan purposes through credit card.

|

| Loan Purpose Reported by Lending Club Borrowers, 2010 - 2012. |

|

| Loan Purpose and Amount Funded for Lending Club Loans, 2010 - 2012 |

While there has been significant growth in volume and total amount funded for loans with reported purpose of debt consolidation and credit card refinancing, the pattern for average loan amount has stayed the same for past three years. The highest average loan amount are for loans for small business, house purchase and debt consolidation purposes.

|

| Lending Club Average Loan Amount and Loan Purpose, 2010 - 2012 |

The average interest rate for debt consolidation loans has risen to 14.11% in 2012 from 12.72% in 2011. The loans for car and major purchase purposes continue to carry lowest average interest rate for past three years.

|

| Lending Club Loan Purpose and Average Interest Rate, 2010 - 2012 |

The table below shows the percentage of reported loan purposes within a specific credit grade. An interesting observation is that the debt consolidation loan purpose was more often reported for lower quality loans with grades E, F and G while the credit card refinancing loan purpose was more often reported for higher quality loans with grades A through D. Another interesting data is that the majority of loans for major purchases and car carry the high quality grade A rating while the majority of loans for home purchase carry the lowest quality grade G.

|

| Loan Purpose and Credit Grade for Lending Club Loans in 2012 |

In my next post, I will continue reviewing the characteristics of Lending Club loans issued in 2012.

No comments:

Post a Comment